work in process inventory balance formula

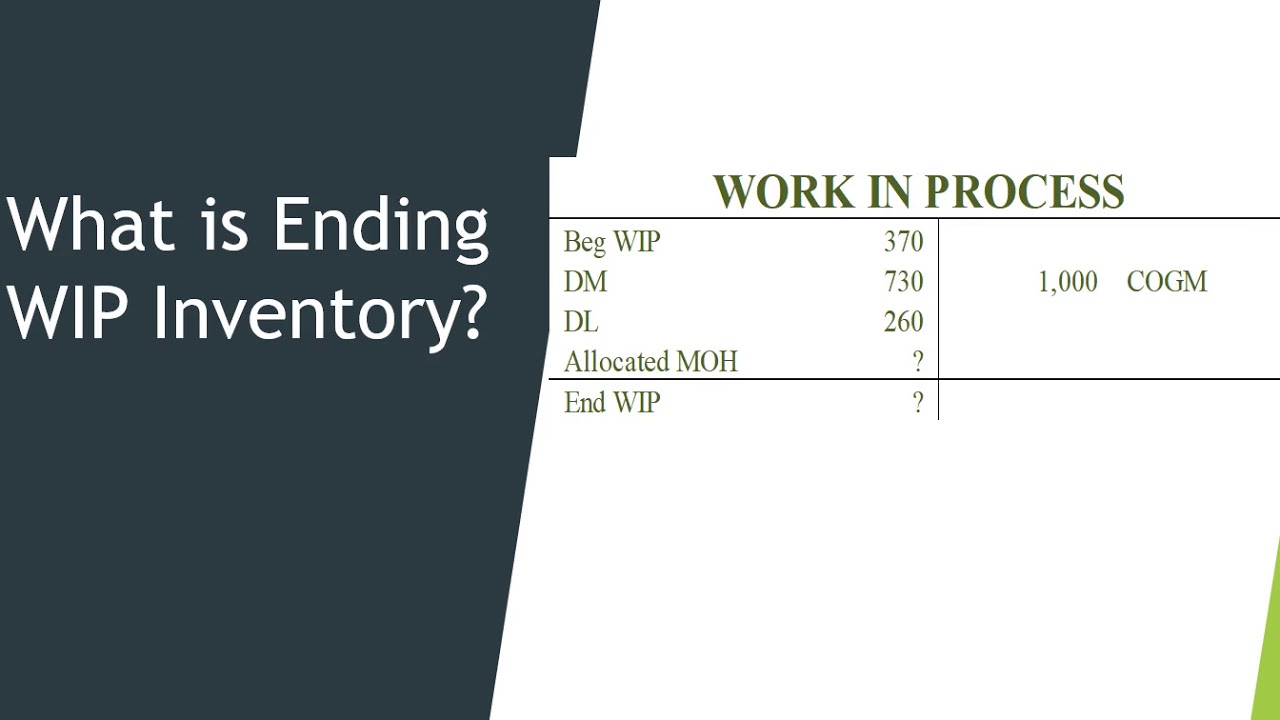

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. The formula for the ending inventory is similar to that of the beginning inventory.

Inventory Control Model Supply Chain Management Management Inventory

4000 Ending WIP.

. Also what does work in process mean. The conceptual explanation for this is that raw materials work-in-progress and finished goods current assets are turned into revenue. This means that Crown Industries has 10000 work in process inventory with them.

Every dollar invested in unsold inventory represents risk. The WIP inventory account is a control account meaning its in the general ledger that is used to. For the exact number of work in process inventory you need to calculate it manually.

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. The work in process formula is. The formula for WIP is.

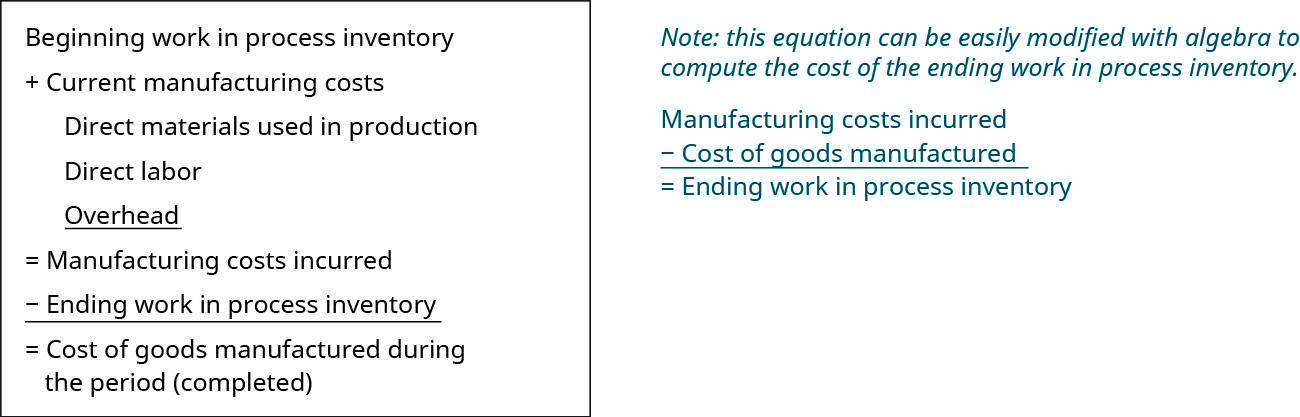

The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. Also known as COGM the cost of manufactured goods is the total costs incurred in the making of a final product. WIP b beginning work in process.

Each figure must be calculated as a running total during the accounting period to make sure the business is producing a profit each week. In this example the beginning work in process total for June is 50000 the manufacturing costs are. Work in process inventory calculations should refer to the past quarter month or year.

The WIP figure reflects only the value of those. Imagine BlueCart Coffee Co. In this equation WIP e ending work in process.

Work in process inventory 60000. 10000 300000 250000 60000. 5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured.

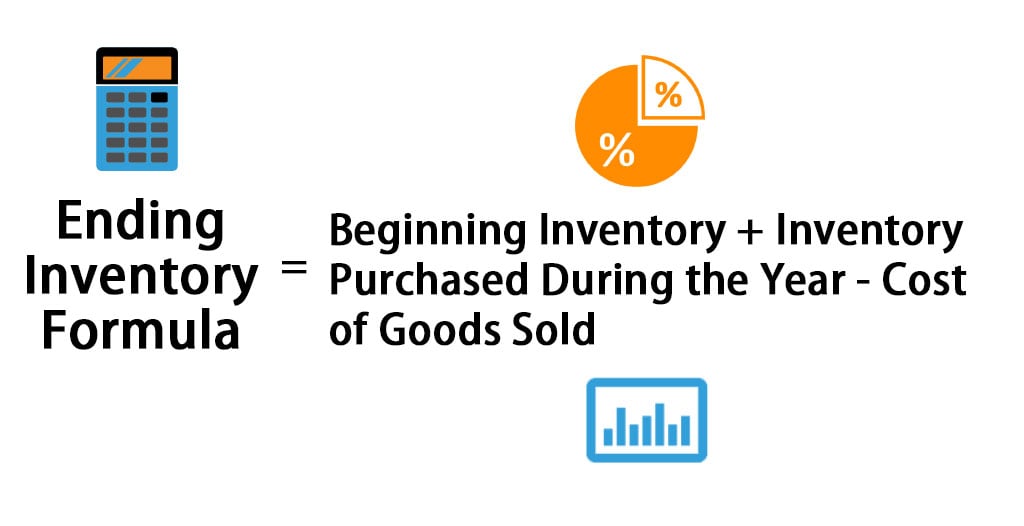

The value of inventory on a balance sheet is the value of beginning inventory plus purchases less the cost of goods sold. How do you calculate work in process inventory. WIP and Job Cost Sheet.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Lets calculate Company As ending WIP inventory as per the formula. Ending Inventory Beginning Balance Purchases Cost of Goods Sold.

WIP consists of the cost of raw materials labor and production overheads with respect to the level of completion. The manufacturing costs incurred in this quarter are 200000 and the cost of manufactured goods is 100000. Take a look at how it looks in the formula.

C m cost of manufacturing. At the end of an accounting period ending work in process is included as a current asset in the balance sheet under the heading of inventory together with raw materials and finished goods. Add the new purchases and subtract the Cost of goods sold.

Work in process WIP work in progress WIP goods in process or in- process inventory are a companys partially finished goods waiting for completion and eventual sale or the value. The formula for COGM is. You have to know the final COGM to calculate the current WIP inventory value.

Work In-process Inventory Example. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. However by using this formula you can get only an estimate of the work in process inventory.

So to calculate ending inventory for the period we will start will the inventory which is currently listed on companys balance sheet. How to Calculate Ending Work In Process Inventory. The last quarters ending work in process inventory stands at 10000.

The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. It is generally considered a manufacturing best practice to minimize the amount of work-in-process in the production area. Its ending work in process is.

Work-in-progress is the goods which is currently in the process of production ie in the intermediate stage of production in between raw materials and finished goods. Work in process operating inventory goods in process raw materials used during the period direct labor during the period factory overhead for a period ending inventory. Formulas to Calculate Work in Process.

The ending work in process is now calculated using the work in process inventory formula as follows. The formula is as follows. Assume Company A manufactures perfume.

Keep in mind this value is only an estimate. Your WIP inventory formula would look like this. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

Ending Inventory Beginning Inventory Inventory Purchases Cost of Goods Sold. The formula for this is as follows. The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory.

8000 240000 238000 10000. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed. Higher sales and thus higher cost of goods sold leads to draining the inventory account.

A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead. WIP does not include raw materials which is yet to be used. Work-in-process is an asset and so is aggregated into the inventory line item on the balance sheet usually being the smallest of the three main inventory accounts of which the others are raw materials and finished goods.

Has a beginning work in process inventory for the quarter of 10000. Lets use a best coffee roaster as an example. Ending WIP Beginning WIP Materials in Direct.

WIPs are considered to be a current asset on the balance sheet. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. The value of the partially completed inventory is sometimes also called goods in process on the balance sheet.

This leaves the company with an ending WIP inventory balance of 4500. And C c cost of goods completed. WIP Inventory amount Beginning Work in Process Inventory Manufacturing Costs Cost of Manufactured Goods Work in Process VS Work in Progress.

Beginning Work In Process Inventory Business Accounting

Work In Process Inventory Formula Wip Inventory Definition

Object Not Found Change Management Visual Learning Economic Order Quantity

Inventory Formula Inventory Calculator Excel Template

Work In Progress Wip Definition Example Finance Strategists

Wip Inventory Definition Examples Of Work In Progress Inventory

Work In Process Wip Inventory Youtube

Ending Work In Process Double Entry Bookkeeping

Ending Inventory Formula Calculator Excel Template

Liquid Assets Learn Accounting Accounting Education Bookkeeping Business

I Will Perform Financial Managerial And Statistical Analysis Accounting Financial Analysis Cost Accounting

Debit And Credit Cheat Sheet Bookkeeping Basics Part 2 What Is Normal A Debit Or A Credit Bookkeeping Business Basics Accounting Classes

Ending Inventory Formula Step By Step Calculation Examples

Financial Report Template Free Is Very Necessary When Approaching To Professional Financial Management Or Profes Financial Management Report Template Financial

What Is Working Capital Small Business Advice Accounting Notes Capital Finance

Balance Sheet With Formulas In Excel Template Balance Sheet Excel Templates Excel

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting